The energy market in Texas is evolving fast. As new technologies, regulations, and usage patterns emerge, the kinds of electricity plans available, along with their risks and rewards, are shifting too. Below, we dive deeper into the major trends that are likely to shape electricity contracts and plan types over the coming years.

What Plan Types Remain Central in Texas

While market changes are underway, many of the main plan types still anchor the market:

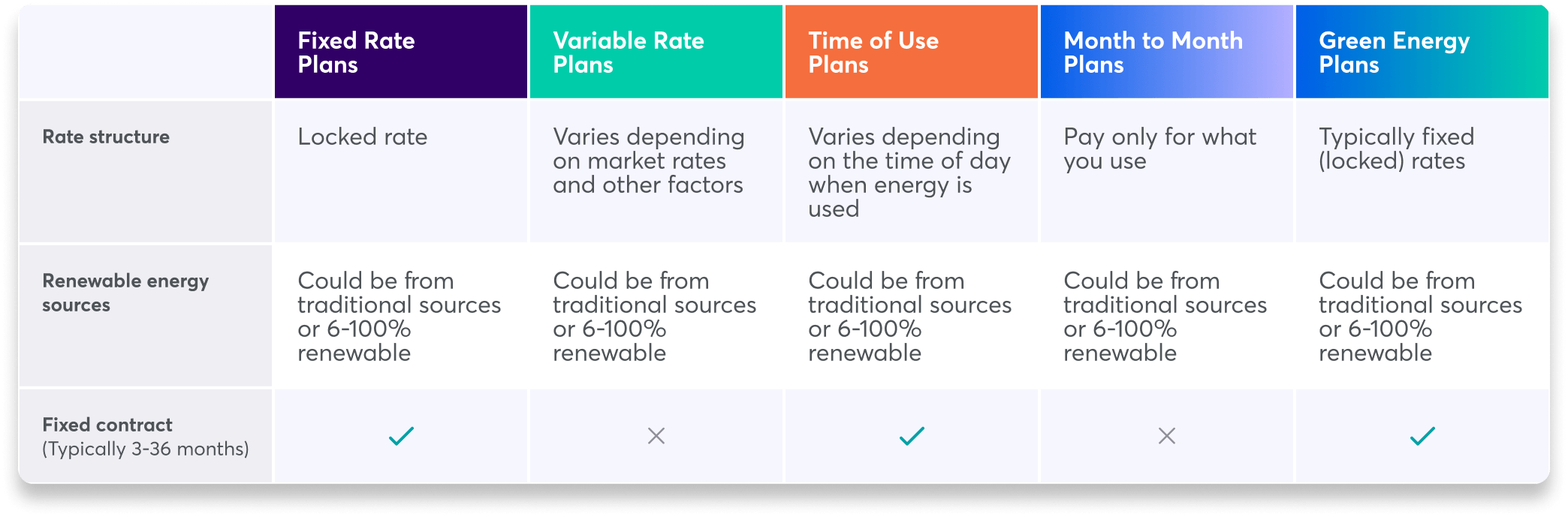

Fixed-rate plans: These remain popular because customers have certainty of cost. A fixed rate means you know what you’ll pay per kilowatt-hour over the contract term.

Variable-rate plans: These shift with wholesale conditions or market indexes. When prices drop, your rate may drop. But you also absorb the risk of price spikes.

Time-of-use (TOU) or time-based plans: These differentiate between peak and off-peak hours. You pay more when demand is high and less when demand is low.

Hybrid contracts: These combine features—such as a base fixed price plus variable portions or TOU components. As markets grow more complex, hybrids may become more common.

Demand-based and usage-adders: These plans charge not just by energy used but by peak demand metrics or add-on charges for certain usage thresholds. They’re still uncommon for residential customers, but we could see them more in advanced residential or commercial markets.

As grid sophistication increases, the line between plan types may blur. Contract structures might embed storage, demand response, or dynamic features more often.

Trend 1: Accelerating Electricity Demand & Tight Forecasts

Texas continues to see rapid growth in electricity demand, driven by population growth, climate trends (increasing cooling demand), and large energy users (data centers, crypto operations, industrial electrification). Some key observations:

Analysts at Ascend Analytics expect future demand to run tight, forecasting 119 GW of peak demand by 2030—less than ERCOT’s projected 209 GW—but indicating supply may struggle to keep pace.

As load growth strains available capacity, price volatility is likely to increase, particularly during peak hours or when unexpected outages occur.

When market supply is constrained, plan types that hedge risk—like fixed contracts or contracts with backup mechanisms—may become more attractive.

That trend makes contracts that offer price certainty more appealing to many customers who want to avoid exposure to sudden market swings.

Trend 2: Battery Storage Scaling Up Rapidly

Battery storage is one of the biggest disruptors in Texas’ energy landscape. Its growth is already affecting plan structures and market dynamics.

As of late 2024, ERCOT had roughly 9.3 GW of installed battery capacity, making Texas a leader in U.S. battery storage deployment. Texas Comptroller

The state is adding storage fast—the market has already added more than 10 GW since 2020.

Storage helps flatten price peaks by charging when prices are low and discharging when they are high. That reduces extreme wholesale price swings, which in turn helps stabilize retail contract pricing.

To remain viable, storage operators must optimize: Simple charge-low/discharge-high strategies are becoming saturated. Market participants are now shifting toward more sophisticated bidding and optimization tactics that factor in ancillary services and price signals.

Policies integrating batteries into markets (e.g., ERCOT’s Battery Energy Storage initiative) are pushing for better integration of storage into grid operations.

As storage becomes more central, future plans may incorporate “storage-enabled pricing,” in which contract flexibility or rate breakpoints reflect how storage smooths volatility.

Trend 3: Renewable Energy Dominance & Changing Supply Mix

The continued rise of solar and wind in Texas is changing how electricity supply is structured—and that affects contract risk and pricing.

Summer 2024 saw solar contribute nearly 25% of midday power in ERCOT. Discharge from batteries filled the evening gap when demand remained high after solar output declined.

More renewable capacity smooths fuel-price volatility. Fossil fuel costs (fuel, transport, regulatory costs) are often volatile; renewables reduce exposure to those swings.

However, solar and wind are intermittent. Their dominance introduces new variability. Contracts may evolve to include more incentives or penalties tied to generation-side risk or grid balancing.

Market participants are watching policies closely. If incentive structures (tax credits, renewable mandates) shift, the relative economics of renewables can change. In Texas, debates are ongoing around mandates that future generation be more “dispatchable”—meaning reliable on demand rather than weather dependent.

That means contract structures that reward flexibility or adaptation to grid signals may grow in appeal.

Trend 4: Wholesale Price Pressures & Contract Impacts

Wholesale prices are sending strong signals into the contract market. As constraints tighten, certain patterns are emerging:

Forward wholesale contracts for 2025–2028 are trading well above historical averages, especially during summer peaks.

Strong natural gas prices, constrained supply, and extreme weather events all push upward pressure on retail rates.

Many providers are choosing to offer more hedged or fixed contracts to protect their customers from volatility.

In environments where wholesale surges are more common, contracts with risk-sharing structures (e.g., capped variable rates or volatility buffers) may become more common.

Trend 5: Infrastructure, Grid Resilience & Regulatory Shift

Behind-the-scenes investments and policy changes will shape contract costs and structure over time.

ERCOT and stakeholders are investing in grid upgrades, weather hardening, and transmission capacity to better handle demand and integrate renewables.

Policies may require generators or storage to maintain reserves or reliability margins, adding cost burdens that could be passed into contracts.

New rules on interconnection, storage compensation, or rate design may lead to more modular pricing options.

Proposed legislation, such as Texas Senate Bill 388, aims to require that a portion of future generation be dispatchable—not just dependent on wind or solar. This could shift cost burdens back toward gas plants or flexible resources.

Emerging demands from large users (e.g., data centers) to use grid resources more responsibly may push more contracts to include demand coordination or flexible load provisions.

What These Trends Mean for Electricity Plans

More Value in Protection: Fixed or hedged plans may outperform variable plans over long periods if wholesale spikes become more frequent.

Greater Role for Flexibility: Time-of-use or grid-responsive plans may become more attractive, letting customers adjust usage when supply is abundant or expensive.

Embedded Storage or Risk Mechanisms: Future contracts may start including optional storage or insurance-like add-ons that cushion volatility.

Green Premiums May Become Baseline: As renewable energy becomes dominant, “green” terms may shift from niche features to standard expectations.

Need for Smarter Consumer Choices: With more complex plan designs, consumers will need to evaluate contracts by how well they align with usage profiles, risk tolerance, and timing of energy use.

FAQs

Will contract prices for electricity in Texas keep rising?

Likely yes. With rising demand, constrained supply, and gas price pressures, wholesale costs are under upward pressure, which may push contract rates higher.

Do battery storage systems help consumers get lower rates?

They help smooth market volatility by discharging during peak times, which can reduce spikes and support more stable pricing.

Do renewable energy additions stabilize electricity pricing?

Yes, expanding wind and solar capacity reduces reliance on volatile fuel costs and can cushion retail pricing against fuel price swings over time.

Will the plans of tomorrow look different than today?

Probably. Expect future contracts to include hybrid pricing, usage flexibility, grid-responsive triggers, or embedded storage and renewable options.