At Rhythm Energy, we stand at the forefront of the energy transition with unwavering enthusiasm and commitment. We wholeheartedly champion the integration of new technologies into our energy landscape, recognizing their potential as the linchpin for a sustainable energy future. Our dedication isn't just about embracing change; it's about ensuring that this transition is executed seamlessly, benefiting both the environment and our valued consumers. As we navigate this transformative era, our focus remains steadfast: to harness the promise of batteries and unlock an energy future that is both sustainable and consumer-centric.

While our enthusiasm for the energy transition and the potential of new technologies is unwavering, it's essential to navigate this journey with a clear understanding of the current market dynamics. The below analysis is meant to present data we've observed during ERCOT's 2023 operations, and identify questions based on this data. The ERCOT grid is at the forefront of the energy transition, with significant wind generation, and rapidly growing solar generation and battery storage. Effective management of this dynamic grid is a responsibility for all market participants, and we hope the questions below can further strengthen the growth of energy transition technologies in Texas.

Why This Matters: In an industry propelled by innovation, understanding the nuances of ERCOT's pricing mechanisms—along with the significance of seamless integration, operation, changing market design, and oversight of new technologies—is essential for a successful energy transition. Neglecting these aspects risks heightened volatility and potential financial implications for consumers in the upcoming years.

Underlying Forces: Key Drivers of Wholesale Electricity Prices

The Energy Reliability Council of Texas (ERCOT) operates an energy-only wholesale electricity market. In this market, generators are paid primarily for the energy they supply to the grid. To incentivize the development of future generating capacity, ERCOT employs scarcity pricing. This mechanism allows for significant increases in the energy component of wholesale prices during periods of tight resource availability. But what exactly is scarcity pricing? Scarcity pricing is an economic concept where prices escalate as supply becomes constrained in a commodity market. As demand nears supply limits, prices rise exponentially, highlighting the increasing scarcity. Two primary drivers cause high wholesale prices in ERCOT:

Increasing Demand and Costly Generation: As demand rises, the grid often relies on less efficient, subsequently more expensive, generation to accommodate the increased demand. This elevation in generation costs, mirrored in generator offers, impacts the system-wide wholesale price. ERCOT's economic dispatch algorithm evaluates these offers to optimize the dispatch of online generation. This component is termed the Locational Marginal Price (LMP). LMP enables electricity prices to reflect the value of electricity across various locations, taking into account both generation costs and the physical constraints of the transmission system. For the sake of clarity and simplicity in the remainder of this document, when referring to LMP (Locational Marginal Pricing), we will consider only its energy component.

Administrative Pricing via ORDC: ERCOT employs an administrative pricing tool called the Operating Reserve Demand Curve (ORDC). The ORDC ensures that electricity prices truly signify supply shortage conditions. This mechanism, named RTORPA (Real-Time On-Line Reserve Price Adder), is added to the LMP, resulting in the real-time wholesale electricity price, known as the Settlement Point Price (SPP).

ERCOT's Ascent: Navigating the Peaks of 2023 Summer Pricing

This summer, ERCOT faced sustained high temperatures leading to unparalleled demand. Consequently, electricity prices fluctuated significantly and, at times, reached peaks indicative of scarcity, even though reserve generation did not look to be in scarcity. This raises pertinent questions: What factors contributed to these high prices? Were the established pricing mechanisms up to the task? And how did this summer's dynamics compare to past years?

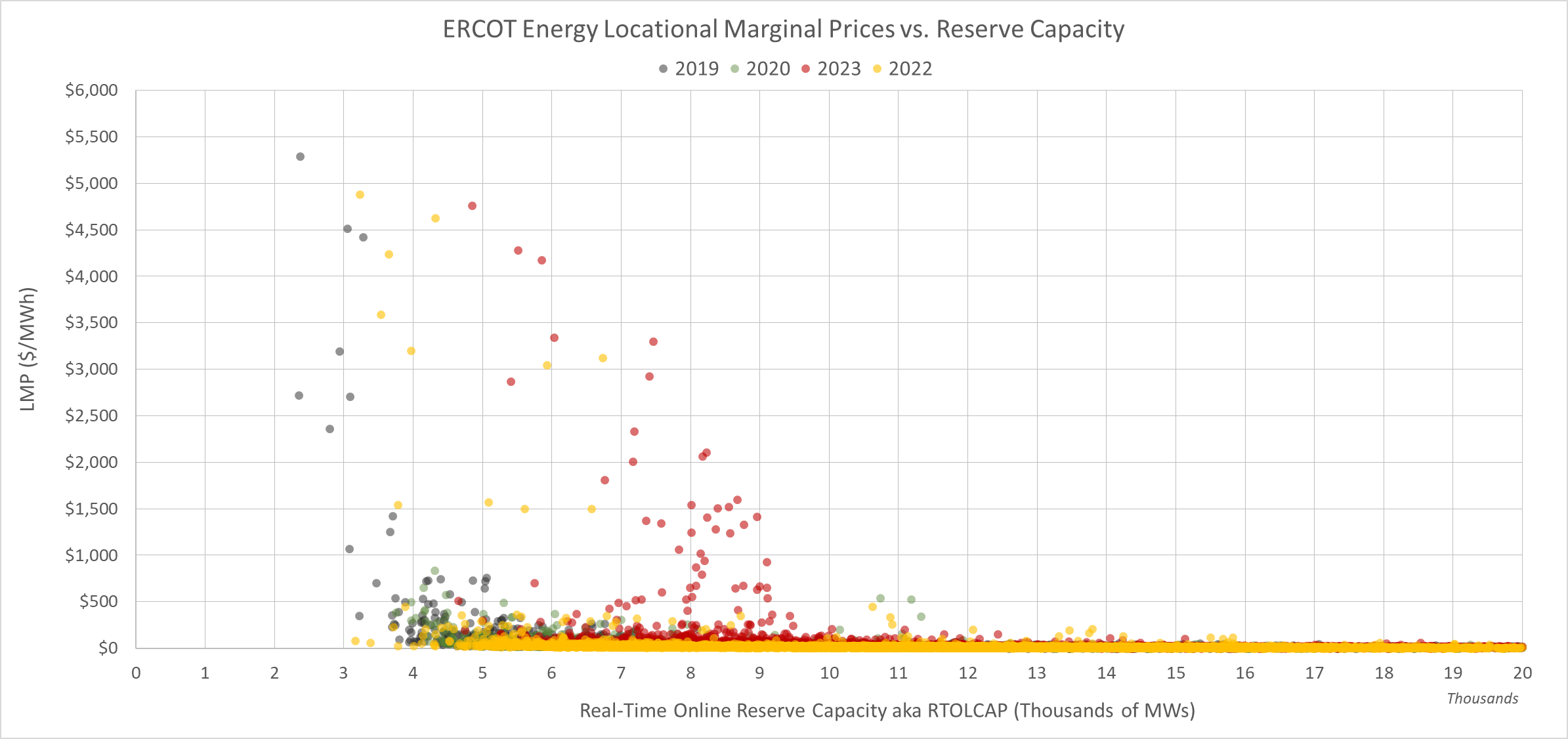

To delve into these questions, we analyzed real-time prices, breaking them down into their primary components: LMP and RTORPA. We then compared these with the available reserve generation capacity. Our study showed that this summer's real-time LMPs were significantly higher than those of previous years, even when reserve capacities were robust and fuel prices were similar or lower. For context, LMPs frequently fell between $500/MWh and $4,000/MWh with reserve capacities of 6,000MW to 9,000MW (refer to Exhibit 1). This shift from historical trends is unusual, and our findings suggest that it's likely attributed to offer prices from generators. While changes to ERCOT’s operational stance, ancillary services product mix, market design tweaks, and transmission constraints can impact price formation, generation resource offer curves set the foundation for price formation.

Exhibit 1 – ERCOT Energy Locational Marginal Prices vs. Reserve Capacity Source Data: Historical Real-Time ORDC and Reliability Deployment Price Adders and Reserves

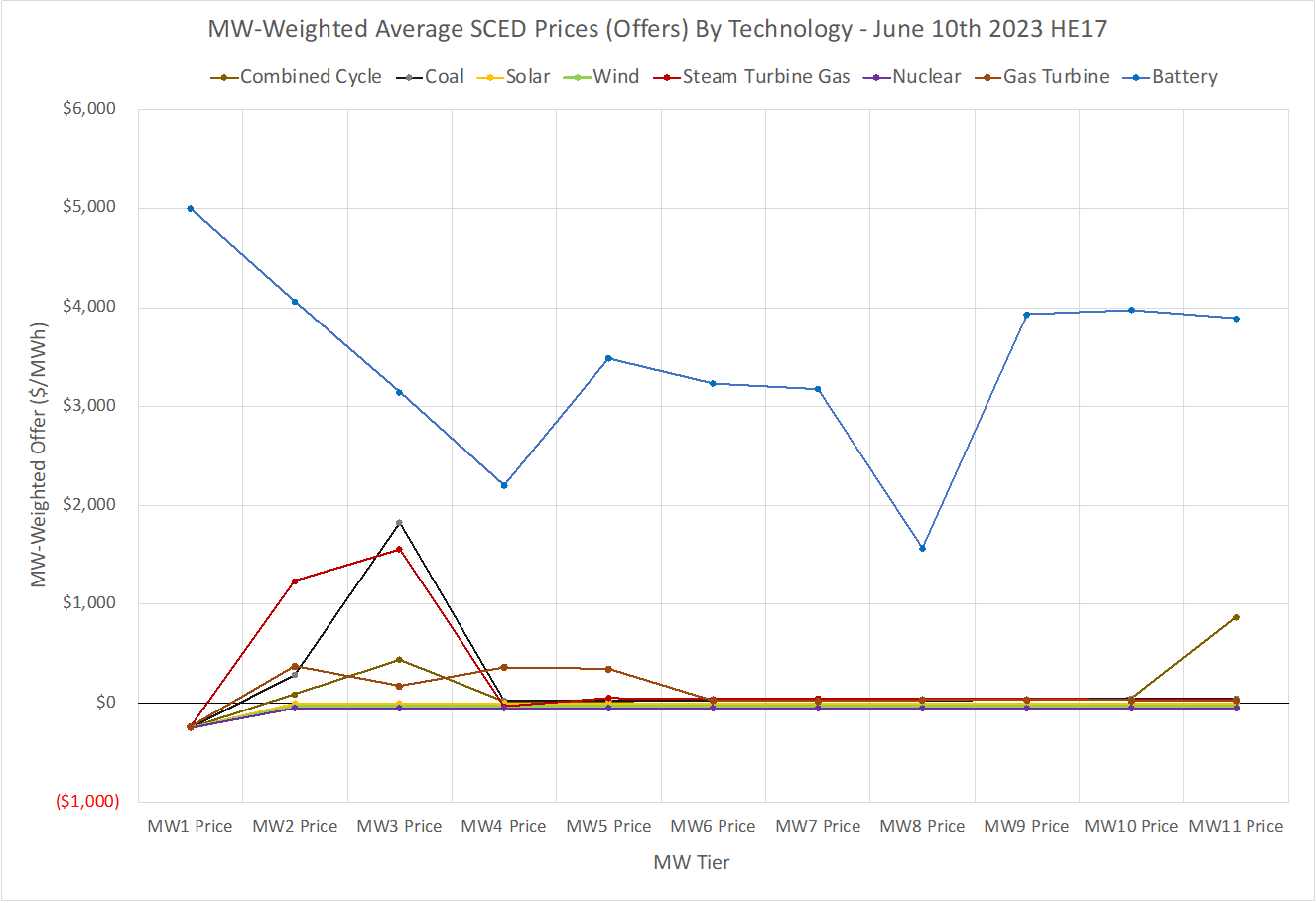

We further explored this trend by examining the available offer curves and June 2023 SCED (Security Constrained Economic Dispatch) prices (refer to Exhibit 4).

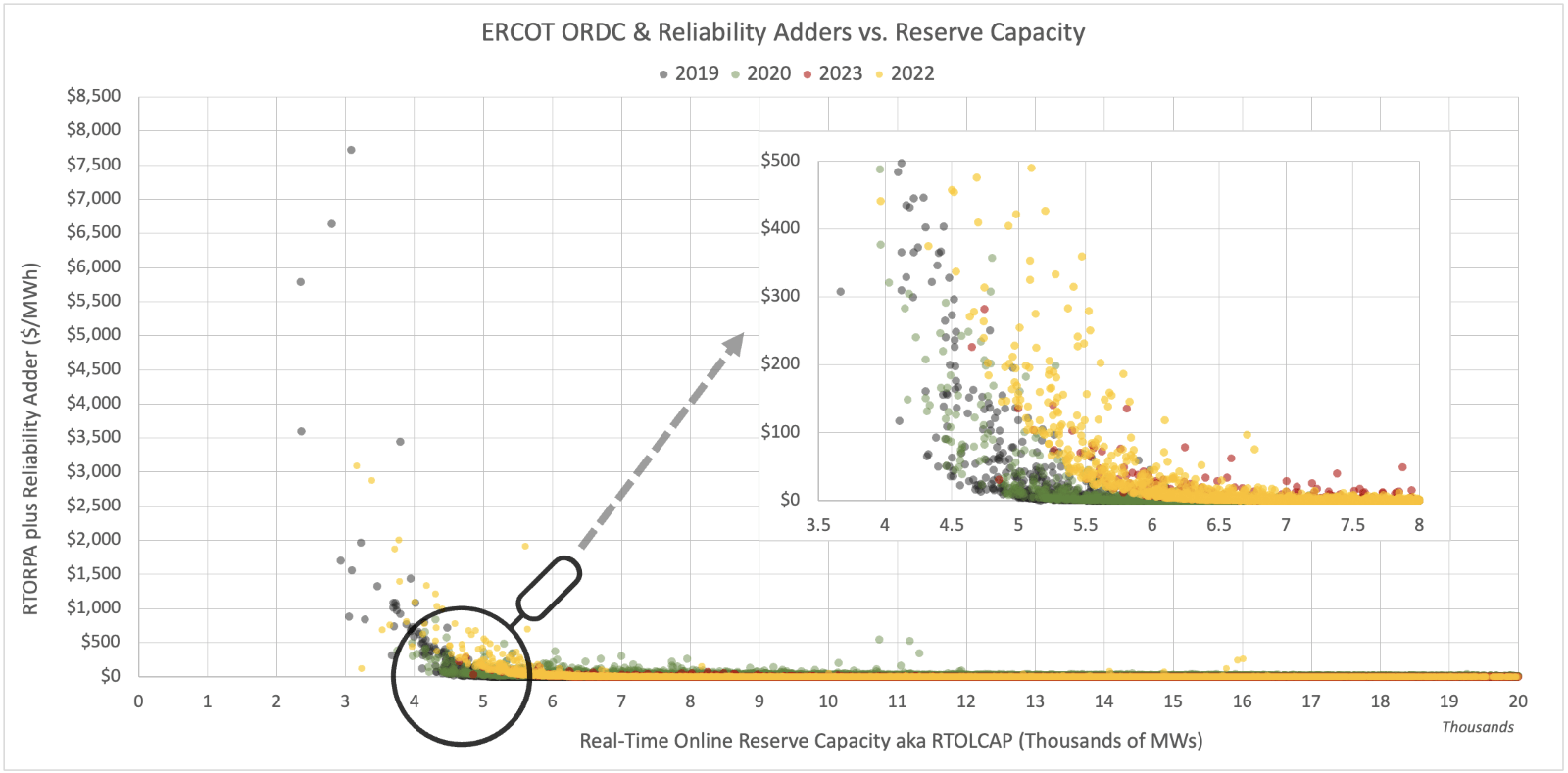

Despite the elevated real-time wholesale electricity prices this summer, the ORDC adder, RTORPA, saw infrequent activation (refer to Exhibit 2). In simpler terms, there were rare instances where reserve capacity dipped into the shortage range. Moreover, since the cumulative LMP and adders cannot surpass the system-wide offer cap of $5,000/MWh, on occasions where reserves fell into the shortage pricing range, because LMPs already approach the $4,500 to $5,000/MWh range, the ORDC adder could not exceed $500/MWh.

Exhibit 2 – ERCOT ORDC & Reliability Adders vs. Reserve Capacity Source Data: Historical Real-Time ORDC and Reliability Deployment Price Adders and Reserves

Examining Offer Curves and SCED Prices

A pressing concern emerges: Why did LMPs soar this year, especially when reserve capacities were robust compared to previous years?

While fully grasping LMP price dynamics is intricate, one significant factor often stands out: the offer curves from generators. With the release of ERCOT's 60-day SCED disclosure report (published 60 days post-event), we now have access to early summer data. This allows us to assess how different generation resources priced their energy offerings.

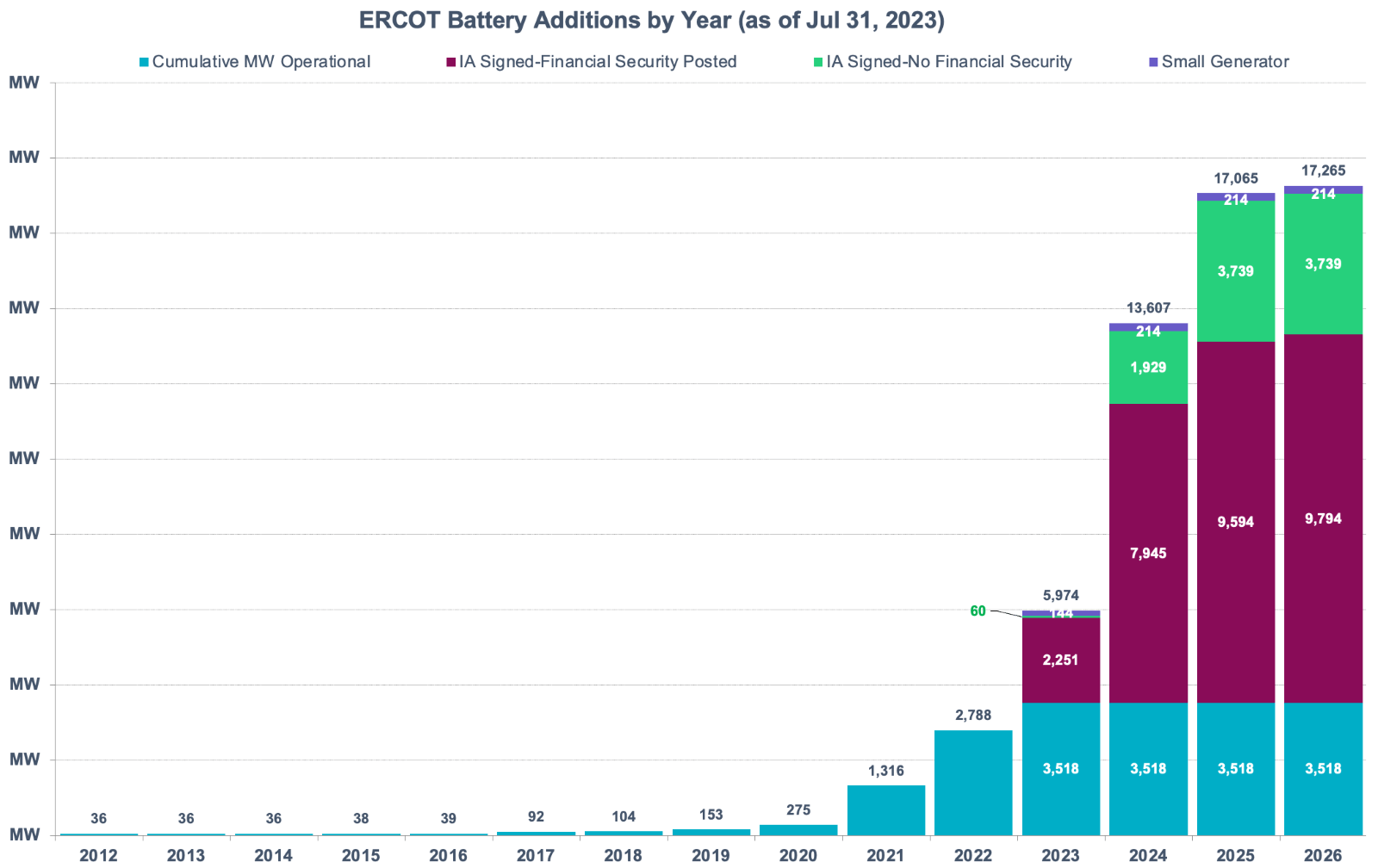

The data suggests that a segment of generation resources, notably battery storage, set their offer prices near or at the system-wide offer price cap. Given the anticipated rise of batteries as the primary dispatchable resource in the ERCOT grid in the coming years (refer to Exhibit 3), this pricing behavior warrants closer scrutiny. Data suggests that other technologies such as natural gas also include certain resources with high offer prices however batteries as a technology stand out in frequency and magnitude of high offer curves, as well as consistency in the offer curves between individual resource. See Exhibit 4.

Exhibit 3 – ERCOT Battery Additions by Year Source Data: ERCOT Resource Adequacy Report (as of Jul 31, 2023)

These offer curves appear to create a semblance of shortage pricing, evident in the heightened LMPs rather than in ORDC adders, even when reserve capacities are deemed not to be scarce. This would imply that a significant portion of the dispatchable capacity integrated into ERCOT, is priced at levels typically expected during emergencies (see Exhibit 4). Rising prices for dispatchable capacity may impact end-users, hinting at potential rate increases by electricity providers if this trend continues.

Exhibit 4 – MW-Weighted Average SCED Prices by Technology for June 2023 Source Data: ERCOT 60-Day SCED Disclosure Report

Key Questions

Pivotal questions remain: Why are certain resources offering such high prices? Has ORDC become redundant in the current landscape?

Could the reasons be operational hurdles in integrating and dispatching batteries, challenges in market design, inherent limitations of batteries on the grid, or another factor? Addressing these questions is essential, given that batteries are poised to play a central role in the transition to renewable energy sources.

The current pricing trends in the ERCOT market, if sustained, could lead to increased electricity rates for end-users, underscoring the importance of monitoring and addressing these market dynamics.